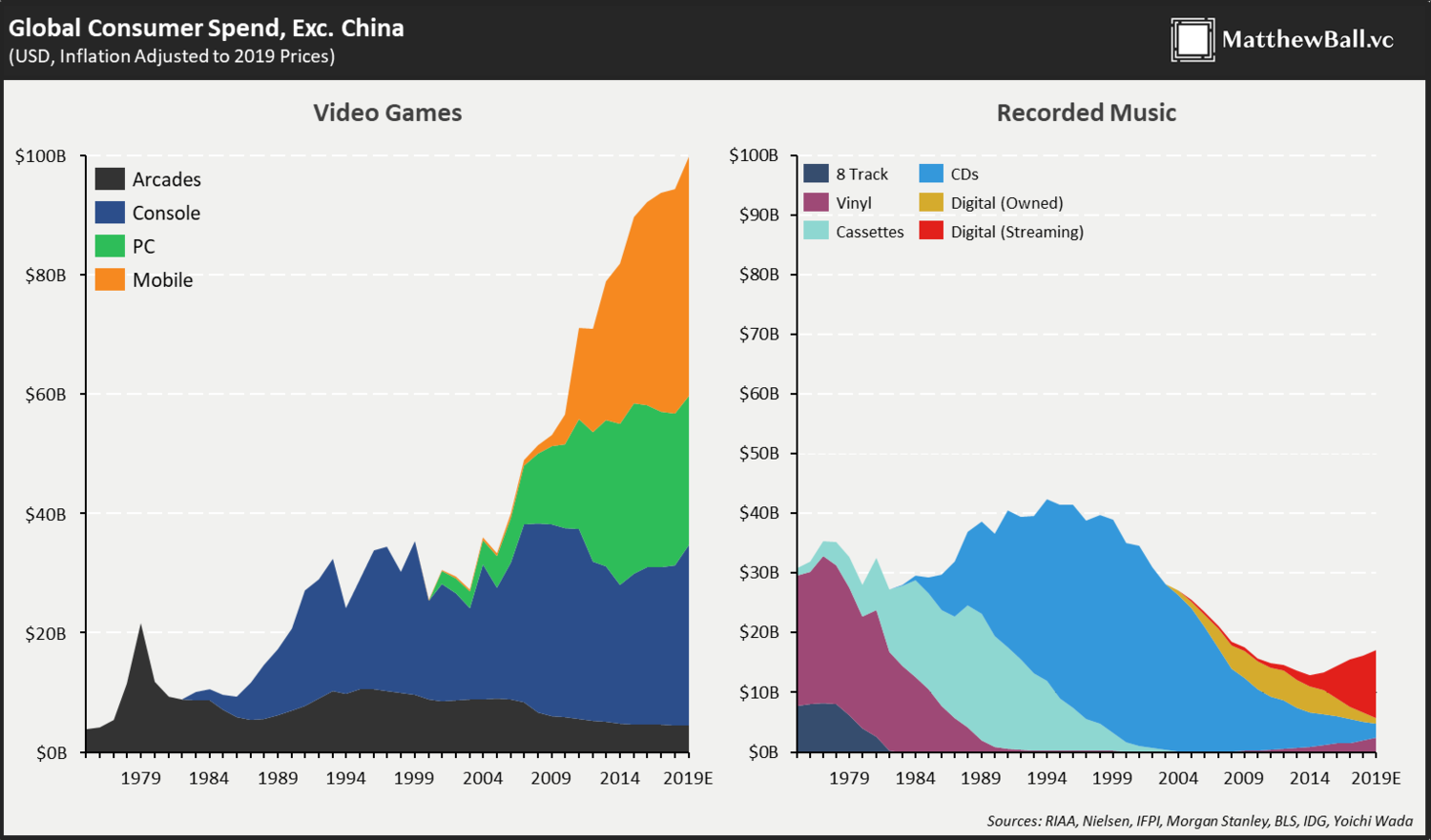

Gaming is considered to be the next frontier in media for its interactivity, immersivity, personalization, and ability to be a social square/space without the need to be physically present. Numerically, gaming revenue is now $120 billion dollars per year compared to the $30 billion and $42.5 billion dollar music and movie industry, respectively.

With an increase interest in gaming, gaming IP should become more popular and can be used to create content through various mediums. Matthew Ball goes into depth on how gaming IP is experiencing modest, but greater success at the box office than in the past, and the soon to be content explosion of gaming IP adapted to TV and films in the next few years.

China has seen an increase in revenue going towards the TV, and gaming industry. TV advertising, and TV and video (digital and physical home videos and subscriptions) revenue has gone up and is projected to increase in the coming years with a total of over $30B in 2016 (In the table below, 2017 and on is expected revenue as the PWC study was published in 2016). Advertising revenue has stabilized, but is expected to grow, while a 38.9% CAGR is expected in online TV advertising. Physical home video sales is expected to decline, but the increase in digital video sales (PVOD) should more than make up the loss. Television subscriptions is expecting a healthy 7.3% CAGR, while on the heels of $18B in 2016.

Even though revenues have been going up in the TV industry, it is lagging TV’s decline in audience, and time spent watching TV (which is similar pattern to the linear broadcast networks and pay-TV channels in the U.S.).

TV viewers are moving (in numbers and time spent) to other, newer spaces of entertainment such as gaming, podcast, live stream videos, video aggregation services (Tudou), and social feeds (WeChat, Weibo, Tiktok, etc.). China’s podcast market is at $7.3B, 23x larger than its $314MM U.S. counterpart because users are willing to pay. Moreover, there were 300MM podcast users in China at the end of 2017, almost the same size as the total U.S. population of 320MM.

China’s gaming market has also grown YoY (although the actual numbers on this is quite varied, but nonetheless, growth is consistent throughout the different methodologies).

PWC:

Wikipedia: which is from http://www.cgigc.com.cn/member/upload/pms/201708/03180814msz5.pdf.

The number of players have increased 10 fold in the span of 10 years. The second chart below shows that gaming revenue has grown from $1.246B in 2008 to $13.97B in 2017 (assuming a conversion rate of 1RMB to $0.14). China’s 2019 gaming population of 630MM shows the demand for gaming is still growing and likely has more appetite.

As of 2019 consumer spend on gaming in China is on par with the U.S.

Furthermore, game viewing (and its market) on Chinese streaming sites has been rising as well. The expected 2022 $5B gaming live streaming market shows there is demand for and awareness of game IP. Huya has seen a steady increase in users from Q1 2018 to Q1 2019. Mobile live streaming MAUs is also on the rise for other streaming (and live-streaming) Chinese companies focused on the population of China. The Huya-Douyu duoply (the top two gaming live-streaming companies) have reached 146.1M and 163.6MM MAUs, respectively, in Q3 of 2019 which is larger than Twitch’s MAU of 140M in February 2020. The increase in game streaming builds marginal affinity of gamers towards gaming IP, which in turn should help an expanded ecosystem of said IP, whether that is the game itself, or any other media content containing the game IP.

With the increase in popularity of gaming, the box office, and TV does gaming IP go hand-in-hand with a hit TV series?

Note: I can barely read Chinese, and there is very limited publicly available English language literature and data on China’s media industry. I am writing this essay based on information I know and can research to the best of my knowledge. I may be not completely accurate with certain claims, so if you find an inaccuracy feel free to inform me, and I will be more than happy to update this essay.

Gaming IP in TV

The prevalence of gaming IP adapted into TV in China has started at least a decade and a half ago (2005). Cross-media adoption occurred earlier than the west likely from the fact that gaming IP adopted onto the silver screen still followed the wuxia (martial arts hero) genre, which was popular in Chinese cinematography since the 1960s. The wuxia genre consists of martial arts imbued with adventure, fantasy, folklore, mythology, Chinese history, supernatural, and philosophy, which is not too far from the legends kids grew up on, and read about – books (and later comics) in the wuxia genre were popular since at least the 1950s, and it draws from Chinese history, which many Chinese are intimately familiar with. So the fact that gaming IP of the wuxia drama is popular on TV should come as no surprise, as there is already a historical link (non-game IP wuxia was already ingrained as a cinematographic culture and language into the Chinese collective consciousness so seeing such dreams and imagination on TV was the logical next step) and game IP TV shows did not deviate too much from what was already popular, only the source content was original and different, not the genre and structural elements.

It is worth reviewing how the dramas based on gaming IP did in terms of rating, and why they achieved such ratings. The Chinese Paladin TV series is adapted from the Chinese action role-playing game The Legend of Sword and Fairy by Softstar Entertainment. The first and earliest show, Chinese Paladin (2005), adapted from the first game of the franchise (1995), achieved a rating of 2.7, with the ratings likely provided by CSM Media Research (created in 1996), which performs about 85% of the linear broadcast ratings report in Mainland China in the year 1999. A peak of 11.3% of the Mainland Chinese TV population watched Chinese Paladin at its initial air time and date. The show would likely rank as the most viewed showed during its timeslot. Assuming 95.8% of China’s 2005 population (1.3B) has access to linear broadcast TV and 11.3% watched Chinese Paladin, that means 140.7MM viewers had their eyeballs on the show. That is more than all but 13 Super Bowls by peak/total viewers and is a distributor’s dream opportunity to maximize advertising spots.

Note: I will not go into depth on this, but there has been numerous publications about the lack of credibility of the TV ratings system in China, and not just because of sampling methodology, but outright corruption (bribery) and manipulation. Nonetheless, I will use the ratings that are available. The methodology of the transferring of ratings to percentage of the Mainland Chinese TV population has changed over the years.

Chinese Paladin’s rating success is not just a fluke. The follow-up, Chinese Paladin 3 (created in 2009) scored top ratings in multiple provinces (unfortunately I cannot find any quantitative ratings in English). Chinese Paladin 3, based off of the third game in the franchise, was produced and not the second game as the director believed the third game had a much stronger story than the second game – therefore showing gaming IP content is important. The next and latest TV show based on the franchise is Chinese Paladin 5 (broadcasted in 2016) achieved a peak rating of 0.88%, which is about 5.13% of the Mainland Chinese population that has access to television – 31MM. Yes, ratings has fallen (reasons discussed above), but the show likely ranked as the 3rd or 4th most watched show during its timeslot. This means it is still an advertiser’s dream to secure a spot for this drama. The average rating of a 2016 Hunan Satellite TV (the public HBO of China as it is the second most viewed channel behind the state-owned CCTV1, and produces the most critically and commercially acclaimed dramas) show is 0.306. Chinese Paladin 5‘s ratings are almost 3 times better than the average show on the HBO of China, which shows that viewers care and tune in to a show based on gaming IP.

The games which the TV shows are based on likely led to a storied run. The first game, The Legend of Sword and Fairy was critically, and commercially successful. 2MM in actual sales, and 20MM copies acquired via piracy. If the game was not as profitable, at least a large audience was extremely aware of the IP, which likely translated to a higher TV show viewing. There are 9 main games in the The Legend of Sword and Fairy franchise plus 12 more spin-off games. There is no doubt once the TV show came on, there was enough IP and a large and dedicated enough fan base for the show to be a hit. Even more, there is a card game, novels, 2 stage plays, a live action web mini-series based on the game IP, with more games in development. Talk about an ecosystem!

Aside from the game and its influence on the TV shows, there are operational and strategic reasons to compliment on the TV side. All of the TV shows starred up and coming or in their prime “idol” actors. The young, diverse (geographically), attractive ensemble cast definitely got many fans’ (not just of the games) attention. It can be assumed that many viewers of the series were part of the teen, young adult demographic. Add the familiarity of the wuxia genre (including the well-designed consumes) and it is almost a no-brainer the Chinese Paladin TV series was a commercial success.

Softstar Entertainment also created another game franchise, Xuan-Yuan Sword, that had its own ecosystem. The first eponymous game started it all in 1990, and now there are a total of 12 games in the main series (with one more set to be released), with 12 spin-offs (plus another in development), and various cross-media pieces – novels, music scores, an animated TV series, and a live action TV show (Xuan-Yuan Sword: Scar of Sky, which is adapted from one of the spin-offs). Xuan-Yuan Sword: Scar of Sky (2012) followed the same formula as the Chinese Paladin series (stunning visuals, wuxia genre). The linear broadcast TV ratings (CSM42) peaked at 2.201 and 10.43% of viewers, and it reached 2B views online. The initial linear broadcast run broke the record for the highest rated weekly drama.

A second TV series based on the franchise, Xuan Yuan Sword Legend: The Clouds of Han, premiered in 2018. It reached a peak rating of 0.743 (CSM52) and 5.045 in viewers, topping out as the 4th most viewed show during its time slot (though another method ranks it consistently in the top 25.

The Legend of Swordsman (2011) adapted from the 1997 online game follows the same concepts as the aforementioned TV shows. I cannot find any information on ratings or views in English, but it probably did well, though probably not as high as the Chinese Paladin series or Xuan-Yuan Sword: Scar of Sky, as the game IP is not as expansive.

A linear broadcast TV show was adapted from the first two games, and a movie was made from the second game. The adaption of the first game, GuJian, is named Swords of Legends, which aired in 2014. Swords of Legends follows a similar format to the aforementioned dramas with the only exception is that it is of the xinxia genre, which is extremely similar to the wuxia genre. Not surprisingly, Swords of Legends topped ratings, market share, and online views during its initial run. Peak rating is 2.45, and 14.8% of viewers for its timeslot. The follow-up Swords of Legends 2 prequel aired on Alibaba’s steaming service Youku, so the viewer count is not disclosed. Adhering to the same production and operation structure of the adapted game IP dramas, the drama likely did well. I discuss game IP adaption in cinemas here.

A linear broadcast TV show was adapted from the first two games, and a movie was made from the second game. The adaption of the first game, GuJian, is named Swords of Legends, which aired in 2014. Swords of Legends follows a similar format to the aforementioned dramas with the only exception is that it is of the xinxia genre, which is extremely similar to the wuxia genre. Not surprisingly, Swords of Legends topped ratings, market share, and online views during its initial run. The follow-up Swords of Legends 2 prequel aired on Alibaba’s steaming service Youku, so the viewer count is not disclosed. Adhering to the same production and operation structure of the adapted game IP dramas, the drama likely did well. I discuss game IP adaption in cinemas here.

Non-Game IP Game Themed Dramas

As the market for streaming services grows in China by users, market share, revenue, and ARPU, more dramas adapted from gaming IP will be on streaming services, whether as a new original content, partnership, or catalogue as the streaming services are becoming anything for anyone at anytime. My hunch is that most of the viewers for the gaming IP dramas are part of a young demographic as the content of the show, and type of actors are geared towards them. Thus, to acquire and keep this population, streaming services would be wise, based on historical performances of drams adapted from gaming IP, to produce such shows with a similar format and content. More importantly, the younger viewers are the ones most adept with technology and are likely the ones that first signed up for streaming services, and make up a plurality of the streaming service’s consumer. Nowadays, TV series are both on linear networks and online platforms.

| Number of Users of All Streaming Services in China YoY |

Number of Users of All Streaming Services in China YoY

Age Breakdown of Customers of Streaming Services in China

Furthermore, since gaming is becoming more popular, there are more dramas that have gaming as a genre or major plot device (without gaming IP), and these dramas are popular and performing well. There are as follow: Love O2O (2016), Go Go Squid! (2019), and Gank Your Heart (2020), with the last drama’s title based off the popular League of Legends’ jargon “Gank,” which means to team up and surprise an opponent. Unfortunately as of the beginning of 2019 some streaming services stopped counting (such as iQIYI and Youku) the amount of online views of a program, hence it would be incredibly hard to access that data.

With the rising interest in gaming, and a idol, romance, and comedy genre, these shows are clearly set-up well to draw demand. Love O2O had over 25 billion views online and one of the most watched modern Chinese drama. The lead actress and actor also won recognition and awards from awards shows of the major streaming services.

Go Go Squid!’s lead actress and actor also won hardware from major award ceremonies. The show became was the most popular one on TV in the summer of 2019 in China while the lead pair, and characters were all ranked #1 in terms of a popularity index in all categories in July of 2019 (the month it aired). The show was also the most searched in three major media platforms of China: Weibo (the “Twitter” of China where the show’s hash tag was viewed more than 12B times), WeChat, and Baidu. Go Go Squid! was also the most streamed series on all the Big 3 Chinese streaming services: Tencent, Youku, and iQIYI. This is even despite the fact that Go Go Squid! also appeared on 2 linear broadcast networks, with a premier pilot episode rating of 0.41, and 0.46 on Dragon TV, and Zhejiang TV, respectively, and was still the top show during its timeslot. The final episode had a rating of 0.96, and 1.5 on Dragon TV, and Zhejiang TV, respectively. Dragon and Zhejiang TV had a 2017 Q1 average rating of 0.288, and 0.266, for their shows, respectively. The average rating of shows (as as whole) decreased throughout linear broadcast networks, making Go Go Squid!’s accomplishment even more impressive, and shows the need to be online as well.

Another example of a successful game/e-sport based drama is the web series Gank Your Heart, which aired starting on June 9th, 2019 on Mango TV (Hunan TV’s online platform, somewhat akin to the HBO Max of China, though catalogue integration is, for the most part, not on the menu). Although not much information on the number of views is accessible in English, taking a look at the first week of ratings, it mostly topped the daily rank of shows that aired on various streaming platforms, with the number of views ranging from 78MM to 120MM per episode. If one assumes, on average, 100MM views per episode for all of the 35 episodes that is 3.5B views, not as much as the other non-game IP game themed series (Love O2O, and Go Go Squid!), but still enough to rank at the top 1 or 2 show through various streaming platforms.

Dramas of video game adaption is taking place across different genres. Cross Fire a modern, realistic web series mixes elements of game IP with drama storytelling is set to air this year (2020) on Tencent. Furthermore, game IP adaption has been happening with Japanese TV shows for a while, but it may not be well known outside the Far East.

Mainland Chinese TV shows adapted from game IP has been happening for more than 1.5 decades, and these shows, which follow a standard strategic, production, and operation set-up, have been popular. With the growing demand of streaming services, and the increasing popularity of games there should be more game IP based and non-game IP game themed dramas. It should come as no surprise if these dramas do well when following a certain structure. Games are actively acquiring their 1UPs through cross-media fluidity, and “Game Over” of their ever expanding ecosystem is not in the foreseeable future.